Social Impact Incentives (SIINC)

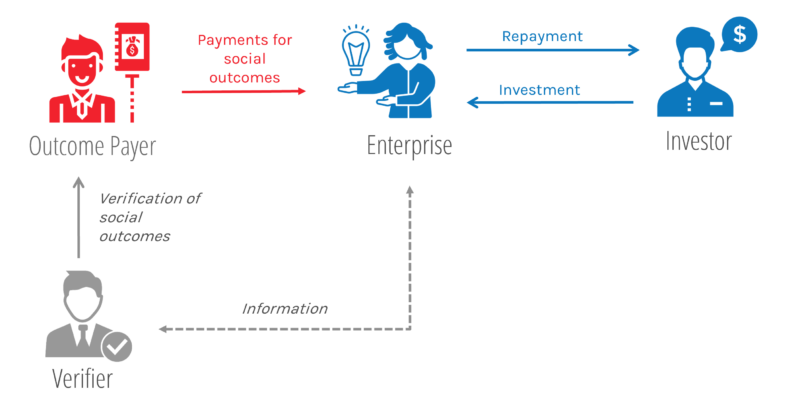

Social Impact Incentives (SIINC) is an Impact-Linked Finance instrument that rewards enterprises raising investment with payments for achieving predefined social outcomes.

SIINC can effectively leverage public or philanthropic funds to catalyze private investment in underserved markets with high potential for positive impact. This combination of catalytic funding and investment makes SIINC also a blended finance instrument.

Why SIINC is relevant

… for enterprises:

The SIINC model makes it possible to scale without compromising on generating strong positive impact. SIINC can act as an additional revenue stream that directly improves the enterprise’s income. With SIINC-related payments, the enterprise enjoys full flexibility about the type and source of investment to bring in.

… for investors:

SIINC improves the risk/return profile of enterprises by rewarding them for optimizing their impact. The enterprise will be able to continue or even accelerate its efforts to generate deep impact while offering sufficient returns.

… for public funders and donors:

SIINC offers great value since an outcome funder only provides time-limited rewards for impact that is actually generated. The outcome funder works with the enterprise to decide on the desired outcomes and on the terms for incentivizing these. If SIINC is used properly, the enterprise will continue to generate positive impact long after the SIINC agreement is finished.

SIINC was co-created by the Swiss Agency for Development and Cooperation (SDC) and Roots of Impact.

Testimonials

SIINC transactions & case library

SIINC was first introduced in Latin America with CLÍNICAS DEL AZÚCAR (CDA) in 2016 and has expanded its scope internationally since. Read how SIINC empowers enterprises to reach impact at scale in our case studies, interviews and data analysis reports published to date:

- CASE STUDY CLÍNICAS DEL AZÚCAR – low-cost diabetes treatments in Mexico

- INTERVIEW WITH PROGRAMA VALENTINA – certified tech-based training programs to support unemployed youth in Guatemala in finding job opportunities

- SIINC DATA ANALYSIS REPORT ON CLÍNICAS DEL AZÚCAR – prepared by Ari Bronsoler from MIT in 2020.

- CASE STUDY KWSH – access to clean piped water in Cambodia – INTERVIEW KWSH

- CASE STUDY AQYSTA – affordable, low-emission, hydro-powered pumps for irrigation in Asia – INTERVIEW AQYSTA

- INTERVIEW ATEC – biodigesters and clean cookstove solutions

- RESEARCH REPORT ROOT CAPITAL – unlocking finance for early-stage agricultural businesses in Latin America